Navigating Financial Success: The Role of a Personal Financial Advisor in Gorakhpur

Managing personal finances can be a challenging and complex task. As individuals and families in Gorakhpur work to secure their financial futures, they often turn to the expertise of a personal financial advisor. These professionals play a vital role in helping clients make informed financial decisions, plan for their goals, and navigate the intricacies of investment, savings, and retirement. In this article, we will explore the significance of having a personal financial advisor in Gorakhpur and how their services can contribute to financial success.

1. Customized Financial Planning

A personal financial advisor in Gorakhpur works closely with clients to create a tailored financial plan. This plan takes into consideration individual goals, risk tolerance, current financial status, and anticipated life events. Whether it's planning for retirement, buying a home, or investing, the advisor creates a roadmap specific to each client's needs.

2. Expertise and Market Knowledge

Gorakhpur's financial landscape is ever-evolving. A personal financial advisor brings expertise and market knowledge to the table, helping clients navigate the complexities of the financial world. They stay updated on market trends, investment opportunities, and changes in tax laws to make informed recommendations.

3. Investment Guidance

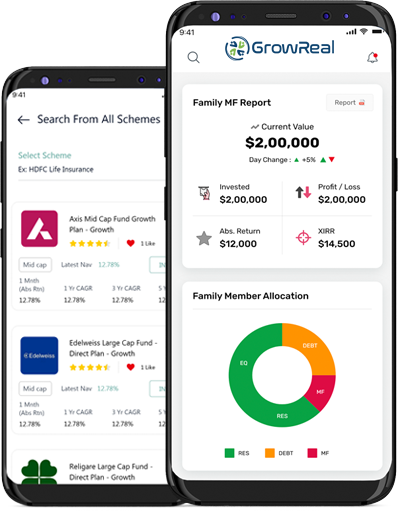

One of the key roles of a personal financial advisor is to provide investment guidance. They assess clients' risk tolerance and financial goals to recommend suitable investment strategies. Whether it's stocks, bonds, mutual funds, or real estate, the advisor helps clients make choices that align with their financial objectives.

4. Retirement Planning

Retirement planning is a major concern for many individuals. A financial advisor helps clients set realistic retirement goals, estimate the funds needed for a comfortable retirement, and develop strategies to save and invest wisely for the future.

5. Tax and Estate Planning

Effective tax and estate planning are essential to preserving wealth and ensuring a smooth transfer of assets to future generations. A financial advisor in Gorakhpur provides strategies to optimize tax efficiency and help clients plan for their estates.

6. Risk Management

Life is filled with uncertainties. A personal financial advisor can assist clients in managing financial risks through insurance and other risk-mitigation strategies. They ensure that clients have adequate protection in place to weather unforeseen events.

7. Debt Management

For many individuals and families, managing debt is a critical component of financial planning. Financial advisors help clients develop strategies for debt reduction, avoiding high-interest loans, and improving their overall financial health.

8. Accountability and Ongoing Support

A personal financial advisor offers clients a sense of accountability. They work closely with clients to ensure that financial plans are followed and goals are met. They provide ongoing support and guidance to adapt to changing life circumstances and financial markets.

Conclusion

Having a personal financial advisor in Gorakhpur is an invaluable resource for individuals and families looking to achieve financial success. These professionals provide personalized financial planning, expertise in investment and tax strategies, and a structured approach to managing and growing wealth. Whether you're planning for retirement, saving for a major purchase, or simply seeking to improve your financial well-being, a personal financial advisor can be a trusted partner in your journey to financial security and prosperity.

For More Info :

Comments

Post a Comment